Table of Contents

- Executive Summary

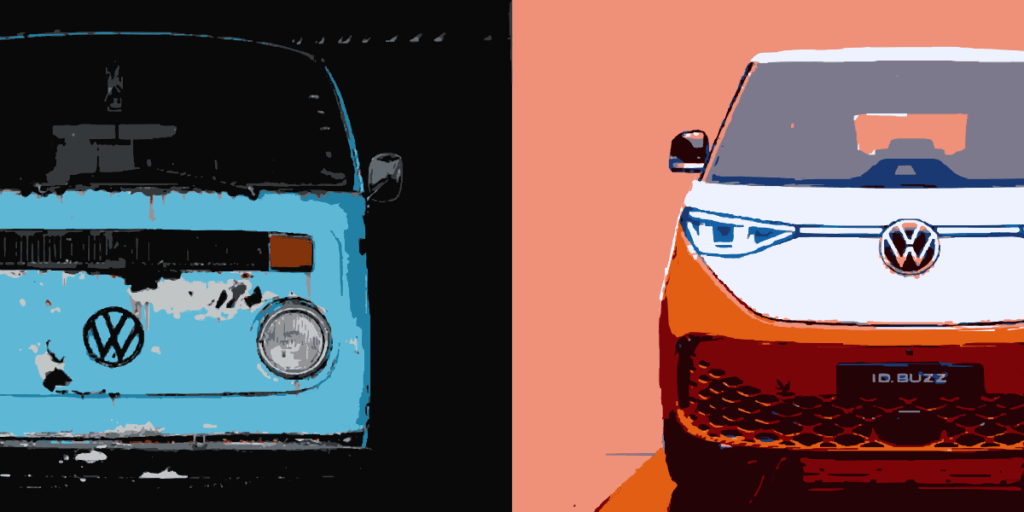

- Intro: Volkswagen AG Basics

- Initial situation: The market’s doomsday forecast

- The historical threat from China

- Further challenges and headwinds for VW

- Impact on profit and cash flow in the “business as usual” scenario

- Volkswagen’s automotive business: Quo vadis?

- Assessment of measures and implications for margin and cash flow

- Deep dive into financial services

- Bringing it all together: Valuation scenarios and key takeaways

- Potential price drivers/catalysts

- Disclaimer

- Further resources

Executive Summary

Market valuation significantly below net asset value: Despite positive earnings and cash flow figures, the automotive business is valued at almost zero by the market.

The current market valuation of Volkswagen AG is difficult to reconcile with the Group’s financial fundamentals. Despite an operating profit of EUR 15.9 billion and free cash flow of ~EUR 5 billion in 2024, the implied market value of the automotive business – based on a valuation of the financial services division at book value – is only ~EUR 0–5 billion.

Competitive pressure from Chinese manufacturers is increasing: Chinese OEMs have significant cost and technology advantages.

The increasing market penetration of Chinese all-electric OEMs in Europe and structural cost advantages (including vertical integration, subsidies, and BEV-optimized platforms) are increasing competitive pressure. According to various sources, the cost advantage over European manufacturers is 30–40%.

Additional external and internal challenges are weighing on earnings: CO₂ targets, structural overcapacity, and geopolitical risks are leading to earnings risks.

In addition to competitive pressure, stricter CO₂ targets, possible punitive tariffs on US imports, and structural efficiency deficits (high overheads, rising personnel costs, underutilization of European plants) are having a negative impact on earnings development.

The base scenario shows a sharp decline in earnings until the end of the decade: In the “no countermeasures” scenario, earnings are expected to be zero in 2029.

Under conservative assumptions, the combination of market share losses, cost increases, and regulatory requirements will result in EBIT close to zero in 2029 for the automotive business. The main drivers are BEV-related margin pressures, declines in China and additional costs from punitive tariffs.

Group management responds with comprehensive package of measures: Cost reductions, new platform strategies and regional partnerships are intended to remedy the situation.

The planned countermeasures include savings of >EUR 15 billion per year, the introduction of the SSP platform from 2028, the “In China, for China” strategy, and the establishment of in-house battery production. In addition, a modular software architecture is planned. The implementation of these measures will be crucial to success.

Market price currently reflects a high degree of skepticism: The current valuation assumes that the measures will have little effect.

The low valuation of the Group implies that the capital market does not currently expect the transformation measures to be successfully implemented. At the same time, it should be noted that if a large part of the planned measures take effect, there is significant valuation and earnings potential.

You’d like to read the full article? Register here:

You already have an account? Login here.